Lessons Learnt from Losing £11,000 in 11 Minutes.

*record scratch*

*freeze frame*

"Yup, that's me. You're probably wondering how I ended up in this situation."

Besides being an overused cliché, this could be the perfect introduction to a Wall Street movie starring me as the main character. So, how did I manage to lose £11,239.45 in 6 minutes and 45 seconds? Let's find out – it's a great story, I promise!

The Memo.

Back in August 2017, I wrote a memo to myself titled "The reason I am anxious is because I do not hedge my bets." It is only a short rant since I usually jot down this kind of notes on the go as they occur to me. I could edit it to be more readable, but I think it would lose the raw emotion behind it. I also think you might find the other ideas in it valuable, hence I am sharing the original text, adding only links in case you are not familiar with the referenced entities.

The reason I am anxious is because I do not hedge my bets.

Investing is the way to go it seems when I’ll have the money for it.

Thought of it during TWiST with Jim Clark. He was on Mosaic and it's a great success, but they didn’t have the power to survive MS when they threw everything against them. Previously at SGI he didn’t have the power to make the decisions as he wanted because he wasn’t a single shareholder. And in the large companies there are too many stakeholders anyway.

So no matter how you structure it, there’s always a way to get blocked. That’s why investing is the best way to reduce the anxiety around failing. Jim’s still successful and gets to work on impactful things, regardless of the fact that individually they flaunt at some point. He is not an investor, just to make a point that you don't have to be the captain of the ship all the time. Keep one project under full control though.

Notice the first sentence. I have been open in the past about the fact that I want to become an investor and this is yet another example of it. While the note mixes multiple ideas and talks about a different kind of investing (angel/VC), the point remains (unlike UK in the EU).

As is probably obvious, I followed through with this idea and on Aug 20, 2018 at 7.34pm I put my skin in the game with the first couple hundred pounds on $TSLA. I have done a few trades using a demo account prior to this, but I am more motivated when the stakes are real, so I do not think I learnt anything from demo trades.

I chose to invest in stocks as I understand them better than forex, crypto, or commodities. Furthermore, I picked only a handful of companies I personally follow anyway to avoid spreading myself too thin.

There are many other reasons I started with trading stocks and maybe I will share those stories some other day, but today I want to talk about psychology as that's where I ultimately failed.

Animal Instincts.

If you want to learn about human nature and our primal instincts, few things provide a greater source of knowledge than finance. The whole mankind functions on the basis of believing in a story about imaginary units of currency we can exchange pretty much for anything our hearts desire.

I have always been fascinated by the effects money had on me and the people around me. Before writing this article, I shared this story with some friends and one reaction I got was "I'm not surprised at all. You were always the biggest gambler I've ever known. I mean, you even run your own betting agency in the class when we were kids." While all of this is true, stock market is something I have never tried despite being aware of it since I was around 12. It was time.

Unlike some people, I do not believe stock market equals gambling. If I wanted to gamble, I would have gone to a casino. This is a game of hormones and intellect, something like poker. Unlike poker though, you can be right and still lose because stocks have no intrinsic value and the price is set by the market. In poker, you can guess your odds of winning based on your hand.

The first time you lose money, it doesn't feel right, at least in my case it didn't. "How could the price have gone the other way? There is no basis for this valuation!" you might exclaim. And you are right. I recommend watching the movie The Big Short if you want to understand this concept in an entertaining fashion.

The New Paradigm.

Soon, I found myself more comfortable with losing money in the markets. Detaching yourself from your wallet is one of the best life tips I can give. I know people scared of investing because some of their investments failed. I know people who lost almost everything and climbed back. Your success is more likely if you stop having emotional relationship with money. It's an instrument to achieve certain goals in your life, just like food. Stop crying over the spilled milk.

As a statistics geek, I also know the numbers. The success rate of day traders is no more than 10%. Yes, that's not a typo. Did I mention this is a game of hormones? I believe I qualify among those 10%, just like the remaining 90% of participants. No, really!

Overconfidence.

Overconfidence is a well-known bias and it rarely helps when dealing with money (obligatory shout-out to my fellow r/wallstreetbets autists). It is particularly dangerous when you become numb to losing money as you start believing you can make it back any time.

After beating the odds for a couple months, I became confident in my abilities and deposited more money into my account to accelerate the growth. I even weathered the October sell-off; despite losing around £3,000 in a week, by December I was back in positive numbers. Surely, this was the time to open the flaps.

The Final Act.

With this setup, we enter the final act of our play. The best way to describe it is a vehicle that slips and the driver tries to stabilise it back to normal. He manages to survive for a while, but with every panic steer the trunk swings further and further. In the end, the inevitable crash happens.

This was my situation after losing £2,000 and making £3,000 back in a matter of hours somewhere in early December. Looking back, it is obvious these numbers were getting out of hand and eventually I'd need to go through the correction as I couldn't afford to keep up with the increasing capital requirements. The correction would either be done by me or my broker. Since you're reading this article, you know which one it ended up being. I was too busy trying to steer the vehicle back on road.

The Crash.

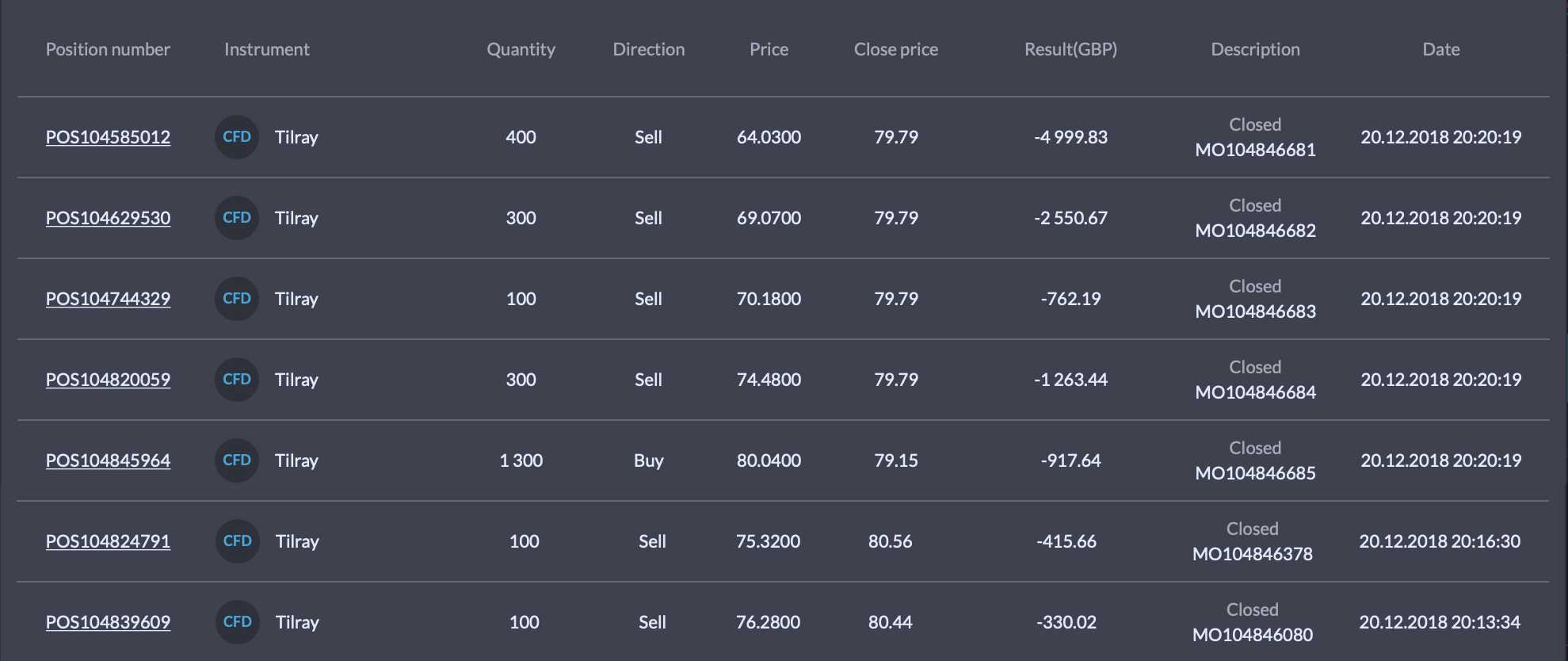

Days prior to the crash, I was on pace for £260,000 in annual profits. Clearly, this could not have been sustained with only a few thousands in deposits. I was playing the high stakes game. What turned out to be a fatal mistake in the end was a combination of 3 errors (they always come in threes) - overleveraging, loss aversion, and miscalculation (overconfidence). To explain the first term, it basically means I borrowed money. The more I borrow, the more I can earn or lose as a result of price change.

Again, even on the last day in our story, I could've closed all positions and walk away with a nice profit. That would require me to admit I was wrong and close some positions with a loss. Instead, as a proud member of r/wallstreetbets, I doubled down on my positions even though at that point, a small movement against me would equal instant death. I cannot be wrong that many times in a row, right?

Right. As soon as the news came out and the price moved 10% up, I made the last desperation move and tried to reverse my position by buying $100,000+ worth of stock. At that point, only a miracle could've saved me. I closed my eyes and braced for the impact. It came minutes later with the car crashing and all passangers dying instantly.

Fun fact: A deposit of £400 would have prevented this had I kept my persuasion as the price fell back in the following days. But who are we kidding, it would only delay a crash with much worse consequences.

The Rainbow After the Storm.

Following the event, I replayed the whole story to gather my thoughts. It was obvious I still loved the game and it would be a shame to throw away months of real experience because of one mistake. I was back on the field the next day.

Two of the most important changes I've made was to reduce my session length from "as much as I can fit into the day" to a few hours and to adjust my position sizes to avoid overexposing myself again. I also realise I will need even better nerves to know when to hold and when to close my positions.

As of today, I am sitting on a profit of couple hundred pounds. Depending on a number of factors, it should take a few months to wipe this loss and I am hoping to end the year with a nice profit. As 50 Cent says, get rich or die tryin'. 🤑